Just when the UK workforce could be going into freefall when an anticipated quarter of furloughed workers will be made redundant by this Autumn, the option to put their skills to work by going freelance will be overshadowed by what many UK private business executives and even House of Lords Economic Affairs Finance Bill sub-committee Chair Lord Forsyth of Drumlean see as an “unfair,” “flawed” and obscure piece of tax-avoidance legislation: IR 35

The UK’s self-employed workforce accounts for 15 percent of the working population and contributes a combined £305bn to the UK economy, according to the Association of Independent Professionals and the Self-Employed (IPSE), yet this huge contribution has long been overlooked and now placed in a precarious position, according to Seb Maley, the CEO of Qdos Contractor, the self-employed tax specialist.

Maley believes that the HM Revenue and Customs (HMRC) has not thought through the larger and long-term economic ramifications that a blanket IR35 tax could have on the larger UK economy during a protracted downturn. Qdos has been handling IR 35 test assessments for corporate and commercial clients and their self-employed freelancers and contractors, so has a had a panoramic view of the wider economic uncertainty that IR 35 has placed on hiring or engaging companies and the wider freelancer community who by nature have sporadic income.

The CEO sees the new clauses of off-payroll working rules as a “needless and short-sighted tax grab from the Government.”

“Over the coming months companies will be in desperate need of expert, flexible and effective resources and the freelancing community should be the first place they turn to,” says Maley.

However, the pending IR 35 tax legislation targeting the self-employed freelance and contractor workforce could compound pandemic-linked economic woes even further by discouraging traditional workers that are fearing redundancy or have been made redundant to put their valuable skills to work by providing their services on a freelance basis.

Losing a lifeline?

In contrast to the last downturn, the freelance sector saw a boom. Freelancer numbers soared across the UK, the US and Europe as a means of financial survival when permanent, on-site jobs dried up. The simultaneous onset of digital infrastructure also propelled the sector’s growth and is propelling it still enabling start-ups to set up an online presence with minimal costs- thanks in part to the IT contractors that helped develop the software.

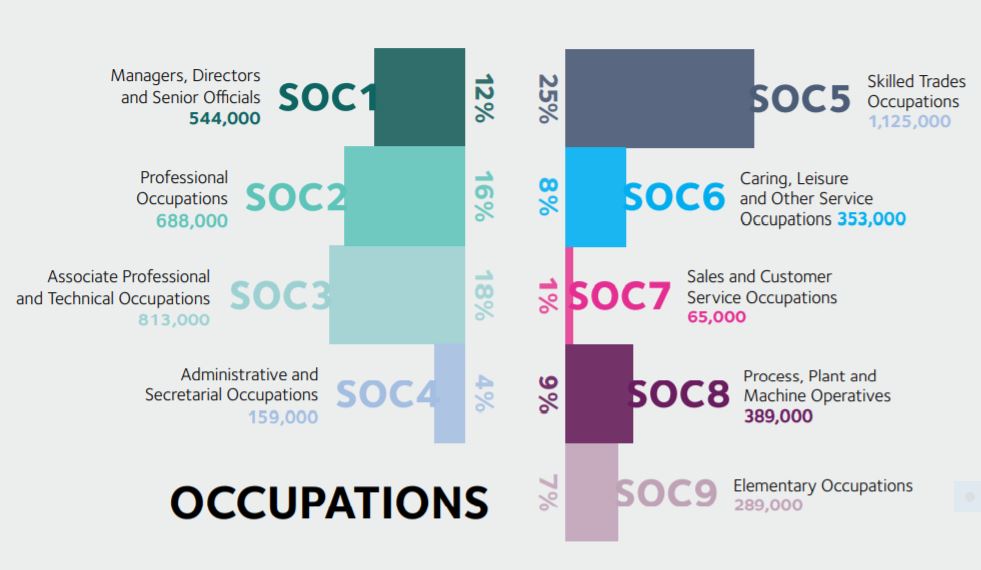

The solo self-employed population alone has grown by 35 percent since 2008, according to IPSE, and this increase has been largely driven by the expansion of the freelance sector. The number of freelancers in highly skilled managerial, professional, and technical occupations has grown by almost 50 percent since 2008.

Another aspect perhaps missing in HMRC’s estimations is that the average age of the UK freelancer is 48, yet the majority are in the 50 – 59 age bracket, highlighting that the combined pandemic and hiring company IR35 jitters could seriously impact this group as they near retirement age and may have no choice than to eat into their personal retirement savings.

A lack of future flexible job creation and security is not the only factor that HMRC could be overlooking for companies and freelancers alike, according to Maley. “There is naturally a large market based around servicing freelancers and contractors too, which almost certainly will not have been taken into account by HMRC when they analyse the potential implications of a major legislative change.”

Arguably, if nearly a third (32%) of existing freelancers are planning to stop contracting in the UK because the changes to IR35, according to research by IPSE, then confidence will be low for those that are anticipating redundancy and have never set up their own business before.

One in five highly skilled freelancers is also expected to have to close their business because of the COVID-19 crisis, according to research carried out this year by the University of Edinburgh Business School in association with IPSE.

Chloé Jepps, Head of Research at IPSE argues that business closures translate into a grim picture for hundreds of thousands of freelancers burning through their savings, having to sell their homes, and struggling to feed their families.

Caught between a rock and a hard place

“IR35 has long been a sword of Damocles hanging over contractors and, naturally, there is much negativity around the legislation,” says Maley.

“A common and incorrect view, which has been propagated over the years by HMRC, is that the decision to work through a limited company is tax-motivated. In the vast majority of cases, this couldn’t be further from the truth,” he says.

Many organisations, end clients and agencies alike have taken the decision not to engage sole traders, for example, over the years, due to risks of them being deemed off-payroll “employees” and risking a potential tax liability even if the freelancer works for other clients, incurs their own company expenses and receives no company benefits (paid holiday, sick pay, pension fund contributions).

For this reason, many sole traders may have been persuaded or given no choice but to set up a limited company to obtain work. Limited companies have therefore increased in popularity, not necessarily because it was favoured by the worker, but upon the insistence of an engager.

“IR35 has long been a sword of Damocles hanging over contractors and, naturally, there is much negativity around the legislation.”

Seb Maley, CEO of Qdos Contractor

Don’t bank on it

But for some, hard times started months before the pandemic even hit the global economy.

To absolve themselves from making case-by-case IR 35 case assessments, banks, including Lloyds Bank and Barclays, were reducing their reliance on limited company IT contractors as early as last year in the run-up to the previous target IR35 new rules date of April 2020, according to a Computer Weekly news report.

“The financial services sector is risk averse by nature, and as such have largely decided to not take the potential tax liability associated with IR 35 tax obligations and have let contractors go,” says a legal director and tax specialist at an international law firm that wished to remain anonymous.

Other banks, according to the Computer Weekly news report, gave contractors “ultimatums” to become permanent employees or only be eligible to supply services if they join an umbrella company to handle their employment status and tax affairs.

If those contractors, for example, had been providing services on-site for a year or more, under the direction and control, say over their working hours, how they carried out their work, and solely working for that client, that would have set off alarm bells and a trigger for the ultimatums, according to an umbrella company source. However, in today’s pandemic-stricken economy, the permanent employee option is looking slim.

In or Out?

“IR35 could certainly discourage some companies from engaging limited company contractors,” says Maley.

“They will likely be aware that the responsibility for determining contractors’ status will move to them from 6th April 2021, which may seem like a daunting burden and potential risk.”

Contractors should do their homework if their clients have not. For example, if a contractor can prove a lacking in mutuality of obligation (MOO) and control, whereby they are not guaranteed work on a daily basis and are only paid on supply of work, they are likely to be deemed a legitimate business and self-employed, rather than as a ‘disguised’ employee.

If on inspection a contractor feels they may be caught in a questionable employee status under IR35 for previous contracts, then there is IR 35 insurance to consider. Liabilities could be significant, with interest and potential penalties added to them.

Insurance should meet the needs of the self-employed inside and outside IR35, which typically has two elements. According to Qdos, firstly a policy will cover the defence costs in the event of an HMRC investigation, given that IR35 enquiries can typically take upwards of 18 months to conclude. Some policies may also go one step further and cover the potential liabilities if a contractor is ultimately found to be inside, or ‘caught’ by IR35.

The key question any freelancer should ask themselves is ‘how much control does the client have over how I carry out my work?’ The second question could be ‘can I negotiate my client contract to ensure I am outside IR 35’? And if not, ‘how do I weigh up the take-home pay loss in additional National Insurance payments in addition to any umbrella company costs’?

As it stands, there is actually very little difference in personal tax between an employee and a contractor, according to Qdos. However, the firm says that the big chunk of tax HMRC is after is Employers National Insurance, which is the 13.8% companies pay on top of their employees’ salaries.

“Unfortunately, for contractors operating inside IR35 this cost is often indirectly passed down to them,” says Maley. “Therefore, in the majority of cases a contractor operating outside IR35 will be in a far better position financially.”

The problem is, will engagers with a blanket mentality hire those outside IR35 contractors? That depends on the sector or a contractor’s tenacity to prove their services can be provided outside IR 35. If the client is happy with the working arrangement, then they are the more cost-effective choice for a client over an Inside IR35 contractor.

The energy and infrastructure industries, for example, have mixed feelings over hiring incorporate contractors and are not being as hasty on downsizing their contractors as perhaps the financial services industry has been, says an advisor serving large energy and infrastructure clients that wished to remain unattributed. This, the source explains, is because certain projects require specialised skills that could be key to a project.

Infrastructure project developers and the construction contractors they work with require flexibility to scale up a project. “Now more than ever”, says the source, “firms are feeling the pressure to keep headcount numbers down, which is why contractors have long been the ideal option,” says the source. That is why firms in these sectors may be more apt to carry out IR 35 assessments to retain those key contractors.

UK-based construction workers on the other hand have the option to join the Construction Industry Scheme (CIS), whereby contractors deduct money from a subcontractor’s payments and pass it to HM Revenue and Customs (HMRC).

The deductions count as advance payments towards the subcontractor’s tax and National Insurance.

Contractors must register for the scheme. Subcontractors do not have to register, according to HMRC, but deductions are taken from their payments at a higher rate if they are not registered.

Education is key

The government has a huge black hole to fill in public finances, which has made many tax specialists believe that the IR35 legislation will go ahead next April. However, there is the hope of reform in light of the lingering economic uncertainty. Masey believes that IR35 reform can be managed but education and preparation are key. That education exercise may in part fall on contractors to ensure their client(s) understand their specific situation.

“If organisations take the necessary steps, there should be nothing stopping them from safely and compliantly engaging contractors, outside IR35, long into the future,” says Maley.