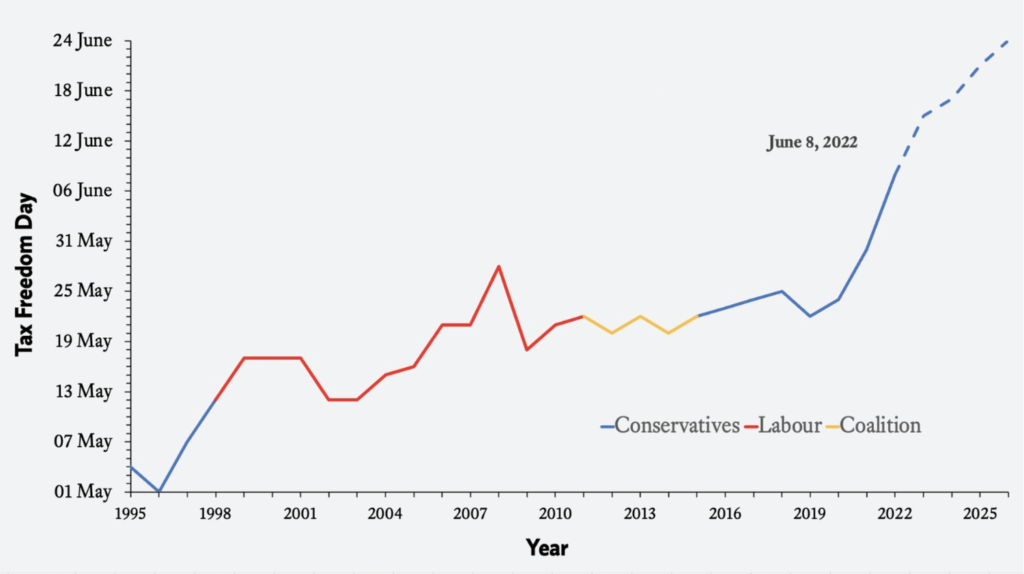

Taxpayers worked 159 days for HMRC this year. The 8th of June is the first day they start working for themselves. But with umbrella company contractors forking out both employee and employer national insurance contributions, and the Apprentice Levy, they could be considered “modern-day serfs”, based on the latest findings from the Adam Smith Institute.

If you haven’t heard of Tax Freedom Day you’re not alone. It’s the day when Britons effectively stop paying tax and start putting their earnings into their own pocket.

In 2022, the Adam Smith Institute (ASI) has estimated that every penny the average person earned for working up to and including 7th June went to the taxman – from June 8th onwards they are finally earning for themselves.

- Tax Freedom Day falls on 8th June.

- Brits work 159 days of the year solely to pay taxes.

- UK Taxpayers will fork out over £869.4bn to the Treasury this year, 43.29% of net national income.

- This is the latest Tax Freedom Day since reliable records began in 1995—and compared to earlier (less reliable) data it is the latest since the mid-80s.

- Cost of Government Day, which factors in borrowing as well taxes, is July 10th—almost a month earlier than in 2020 but 4 days later than last year.

- MPs have provided comments in support of Tax Freedom Day, recognising the need to reduce the burden on people and businesses during a cost of living crisis. The Adam Smith Institute suggests it is now incumbent on the Government to lower taxes to boost growth and investment.

- The Chancellor’s decision to freeze a series of tax thresholds, such as income tax, until 2026 means the tax burden will only grow.

- A 1.25 percentage point increase in National Insurance was also introduced this year.

“If people were forced to work two full days a week for the Government, they would regard it as a form of serfdom,” says Dr Eamonn Butler, Founder and Director of the Adam Smith Institute. “But that is what they actually do, as the Government takes over 40% of their earnings in tax, and then it borrows because it still can’t keep its book balanced.

“All this taxation eats into our economic growth. It increases the risk of starting a new business or investing to expand an existing one, choking off the recovery we desperately need right now,” he says.

If people were forced to work two full days a week for the Government, they would regard it as a form of serfdom.

Dr Eamonn Butler, Founder and Director of the Adam Smith Institute

The Rt Hon Lord Frost explains what it means when Tax Freedom Day arrives later each year:

“Tax Freedom Day comes later every year, but a jump of a whole week shows just how much this Government has raised taxes in recent months. We need to reverse this trend urgently and get the British people working for themselves again, not paying more and more for an increasingly inefficient government.”

Tax cuts are the answer say many MPs, including The Rt Hon Ian Duncan Smith, MP for Chingford and Woodford Green:

“These figures are a terrible reminder of just how much tax we already pay to the Government. The purpose of this Government should now be to reduce the overall tax burden to allow those who work hard for their families to keep more of the money they earn and give less to the Government. That is what real freedom means.”

Others like Rt Hon Penny Mordaunt, Minister for Trade Policy and Member of Parliament for Portsmouth North, agree:

“To increase revenues and growth for the nation, cut taxes. To improve options and opportunity for individuals, cut taxes. To balance the state and generate wealth funds for future generations, cut taxes.”

Helen Morrissey, senior pensions and retirement analyst at Hargreaves Lansdown says the figures compiled by the ASI are “startling” with that figure set to get even worse in the coming years, as the series of tax threshold freezes (which remain in play until 2026) continue to bite huge chunks out of our income.

She explains: “Income tax is the biggie – freezing the personal allowance and higher rate thresholds until 2026 means more people are being dragged into paying more tax over time. Added to this, the 1.25 percentage point increase in National Insurance introduced in April will ensure their tax take is pushed up even further. It makes for depressing reading at a time when people are already struggling to meet the rising cost of living as inflation soars to 9%.”

She says other “hidden horrors” pushing up your tax bill could be more taxes such as inheritance tax – the £325,000 threshold has also been frozen, as have the pensions annual and lifetime allowances.

Recent government data shows the number of annual allowance breaches has soared in the past few years as people grapple with a complex system that could see your annual allowance as high as £40,000 or as low as £4,000.

“Freezing these allowances will only see more cash pour into HMRC coffers as time goes on,” says Morrissey