How to avoid late payments as a freelancer

Feel like you are working for some clients for free? New research shows the common causes of why freelancers could be getting paid late and how to avoid them

When a freelancer lands more than one client that pays them on time, it’s like striking gold. Yet, it’s absurd that freelancers should feel grateful for getting paid on time for a delivered service or product. Would a supermarket feel especially grateful or lucky when a customer has a basket full of items, and breezes past the check-out saying, “I’ll pay you later!” No way, right?

Freelancers and small business owners are increasingly giving suppliers more credit when they can’t afford to. It’s becoming an unsustainable practice. There are 1.57 billion people in the world who are freelancers, which is almost 47% of the global workforce. Here’s another fact, 75% of them are getting paid late.

What’s causing freelancers to get paid late?

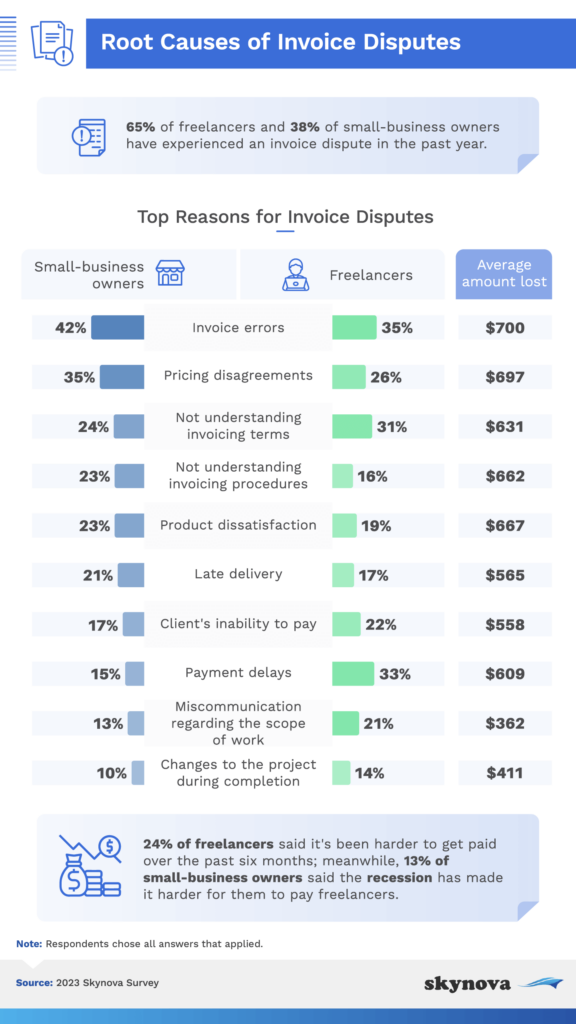

In the past year, 65% of freelancers and 38% of small-business owners in the US alone, for example, have experienced an invoice dispute. That’s according to a new study that found that the leading cause of freelancers getting paid late is because of invoice “errors”.

The researchers found that pricing disagreements were at the root of these conflicts for 35% of small-business owners, while nearly as many freelancers (33%) listed payment delays as the primary cause. Some small-business owners seemed to verify this; 13% reported difficulty paying their freelancers due to the current recession.

Invoice disputes as any freelancer who has experienced them, can have serious financial impacts on paying for essentials like rent, a mortgage, food, petrol, loans, utility and credit card bills. Small-business owners also rely heavily on income, and late or delayed payment by a client can lead to legal action or debt collection.

“It’s important to have a clear understanding of invoicing terms and procedures to prevent these costly outcomes,” says Skynova, an invoicing service for freelancers who carried out the survey of 500 freelancers.

Key Findings

- Roughly 39% of freelancers have lost income due to an invoice dispute

- About 1 in 4 freelancers have lost about $784 (£630) due to pricing disagreements regarding an invoice.

- The no. 1 reason for an invoice dispute among freelancers is due to invoice error costing freelancers an average amount of $677 (£544).

Time to say goodbye to a client or try a new communication tactic?

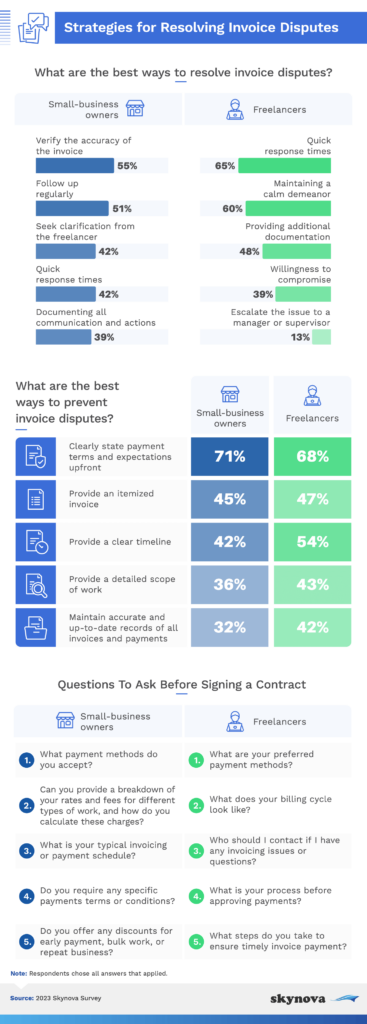

While negotiations can be a viable strategy to resolve an invoice dispute, the researchers found this isn’t always the case: 35% of small-business owners and 27% of freelancers said that they’ve dropped the other party as a result of an invoice issue. And on average, both parties were only willing to negotiate two invoice disputes before refusing to work together again.

Strained relationships were the most frequent impact of invoice disputes on small-business owners (42%). Freelancers, however, were more likely to say it was delayed payment (47%). But across the board, the most common way to end a freelancer/client relationship was to send an email (53%).

These outcomes underline the importance of careful communication and understanding when it comes to invoices, as well as the need for businesses to take appropriate steps to mitigate risk and ensure timely payments.

“It’s possible to prevent invoice disputes from becoming too contentious,” says Skynova.

Steps freelancers can take to resolve invoice payment disputes

Skynova provides the following steps that small-business owners and freelancers can take to resolve invoice and payment disputes and aim for positive working relationships. They present some questions freelancers can ask before signing a contract.

However, these in the opinion of The Freelance Informer team seem to be placing all the control in the client’s hands rather than the freelancer who is providing the service or end-product. This is where we find things have gone wrong in the freelance economy for far too long.

Unless you want to live out your retirement days in poverty, then you have to start putting the financial needs of your business and your survival first. Every freelancer wants to be respected and paid on time and with payment terms that enable them to thrive so they can put more money in say a pension. To do that they have to be confident enough to call more shots in a professional manner. In the current cost of living crisis, you may have to change your payment terms and rate within reason. That means adding a certain percentage rate rise in line with inflation and requesting that payment is made sooner.

As a freelancer, you really should avoid discounted rates for getting paid sooner, but if you do, price in some of that discount into your updated rate(s) to cover yourself. Consider offering more services as a bundled project rate to avoid those clients that question every minute as a delaying tactic, which can mean invoice disputes and late payments. Neither of which you can afford.