In the UK, small business job losses look to have been almost double the losses for big businesses, according to a Xero Small Business Insights report. Without a sustainable recovery in small business based jobs it will be very challenging to achieve an economy-wide employment rebound, the research has found.

This means governments, especially the UK, need to ensure that small businesses have a seat at the policy development table and that programmes to assist them are front and centre of broader recovery plans.

Xero’s research estimates that 2.9 million new small business jobs need to be created over 2021 in Australia, Canada, New Zealand, the United Kingdom and the United States to get back on the growth trajectory that the small business sector was on before the shock of the pandemic. Over two-thirds of these jobs are in the United States.

Limited company directors, owners of small businesses in the UK, that have not been able to pay themselves a salary or receive direct government support because they are a one-person outfit or even those with a few employees that have received furlough funding for their employees, but not themselves, are in dire straights.

Campaigns including ExcludedUK and ForgottenLtd have expressed that many of these small business owners and the families that are dependent on them are hurt by the injustice of it all; the inequity of why some taxpayers receive government support to keep them surviving in the pandemic, and others like them — nothing.

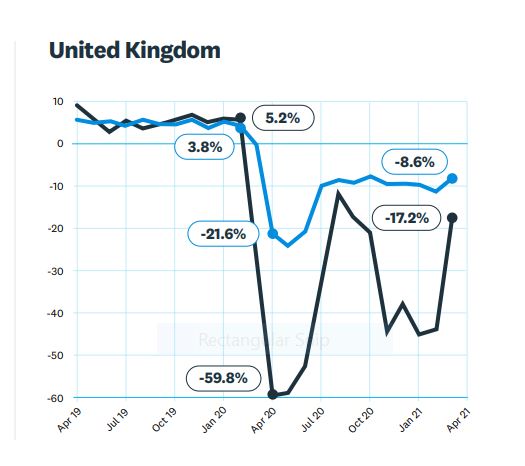

Hospitality experienced greater initial job losses and a slower recovery

Source: Xero Small Business Insight

Women experienced greater initial job losses and a slower recovery

Government grants: do you have to repay them?

Did you know that there are different government grant schemes offered by the UK government that you never have to repay? However, these programmes are extremely difficult to obtain in comparison to other schemes such as government low interest or no-interest loans, according to UK Startups, an online portal that offers guidance and online tools for those looking to start their own business.

“On the bright side, as a small business owner looking for funding, a government grant is a possibility,” said UK Startups. “If you are able to obtain a grant that you never have to repay, you must ensure that you act in accordance with the funding agency and programme regulations.”

Since there are many different types of government grants, the availability of non-repayable government grants may depend on your region, your industry and your funding needs. However, the good news is that funding is available, so your next search should be in the Funding Database to find out which programmes your small business can actually get.