Freelancing is the ideal soft landing for retirement

Don’t retire. Go freelance. This societal mindset could radically improve the world’s workplace talent pool and financial viability going into full retirement, argues data scientist Erik Stettler

Our work is a big part of our identity. When someone retires, it’s very much like closing a chapter of your life and for many, a loss akin to death, says Erik Stettler, a data scientist, a founding partner of the global venture firm Firstrock Capital and Chief Economist at Toptal.

Some 44% of millennials, 33% of Gen Xers, and 36% of baby boomers plan to seek work in their retirement years, according to a 2021 report by the National Institute on Retirement Security. In a 2021 Harris Poll of American workers, 79% of baby boomers said they want to transition to semiretirement rather than disengage from work entirely.

According to Stettler, this trend has become widespread—and talent shortages have become so acute—that forward-looking firms like Microsoft and Marriott are creating programmes to support and retain mature workers. Some employers are starting to offer semiretirement opportunities—but the movement is not as broad as it needs to be to accommodate all of the experienced workers who aren’t quite ready to retire.

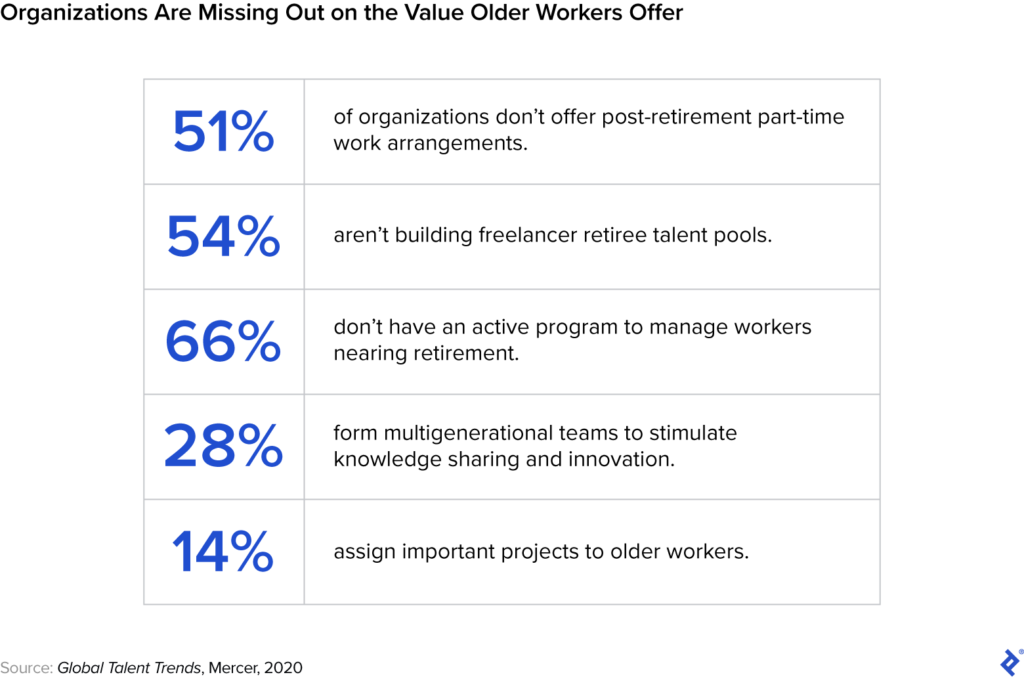

“Despite the benefits of continuing to work later in life, most organisations do not yet offer flexible and part-time work options in lieu of retirement, a missed opportunity for both employees and employers,” says Stettler.

Between late 2018 and late 2020, the UK’s state pension age for men and women rose from 65 to 66, meaning that the approximately 700,000 65-year-olds in the UK had to wait another year before they could receive a state pension. The key impact of this was that 65-year-olds missed out on state pension income of £142 per week on average.

These reductions in state pension income meant that the absolute income poverty rate for 65-year-olds rose by 14 percentage points, or nearly 100,000 people, to reach 24% by late 2020. The higher state pension age also encouraged around 9% or 60,000 more 65-year-olds to stay in their job and retire later.

These are some of the key findings of new research published by researchers at the Institute for Fiscal Studies, which has been funded by the Centre for Ageing Better.

If companies and pension policy and labour policymakers embraced freelancing as a viable bridge between career and full retirement, they could see a radical improvement in retaining talent, pension poverty, solving the cost of living crisis and generating ongoing tax revenues.

“Modern freelancing involves fewer points of friction and a lighter administrative lift than what many workers in the baby-boom generation might perceive,” says Stettler.

“For example, Toptal and other contingent talent networks handle the burden of sourcing and billing clients on behalf of freelancers, enabling skilled professionals to focus on the work they love, not administrivia,” he says.

Eliminate false choices over how you work

Stettler says he sees freelancing as a way to eliminate what he calls “the false choice” of whether to work full-time or not at all.

He believes people can essentially “leapfrog into a life” that closely resembles those long-awaited “retirement years” while avoiding the sense of loss that often accompanies giving up work entirely.

“Even when working beyond traditional retirement age is born of necessity rather than desire, freelancing can increase the chances that such work can be done remotely, with more flexible hours, and in alignment with workers’ interests,” he says.

“This not only benefits workers but also organisations and the economy as a whole, as these professionals continue to contribute skills and knowledge acquired over decades,” says Stettler.

Stettler hopes that society starts to accommodate for a “retirement” shift whereby a continued workforce engagement in a person’s later years, through freelancing, becomes the norm rather than the exception.

You can read Stettler’s full report here: Redefining Retirement: The Benefits of Freelancing After 60