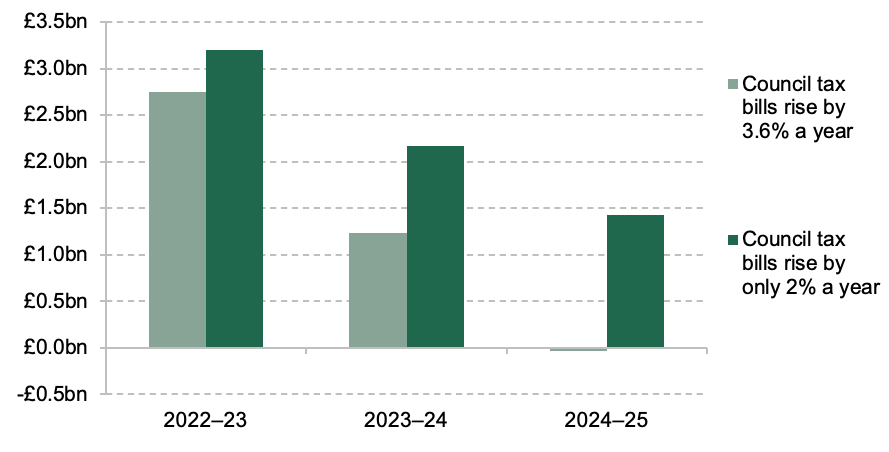

Under current government spending plans, council tax increases of 3.6% per year will be needed for the next three years just to ensure councils can provide the same range and quality of services in 2024–25 as was provided pre-pandemic, the Institute for Fiscal Policy has reported.

The news of any more taxes, especially for the self-employed, could put some freelancers and umbrella contractors over the edge. Many will feel compelled to take on more work where available, which could put even more pressure on their personal lives, just so they can make ends meet.

The authors of the report have also found that the annual cost of meeting the government’s ambitions for social care is likely to be around £5 billion a year, almost three times the average annual funding planned over the next three years.

This would push up the average annual bill paid by households by £160 by 2024−25, or £77 after accounting for inflation. In fact, this is likely to be a minimum requirement.

Bigger increases in underlying demand and cost pressures, or top-ups to other budgets (such as schools) which eat into the amount available for grants to councils, could easily push up the necessary council tax rises to 5% per year, or by over £220 by 2024–25.

Just how underfunded are councils and social care?

The government’s stated ambitions for social care are underfunded said the IFS. These are likely to cost £5 billion a year in the longer term, almost three times the additional annual funding currently allocated over the next three years.

These are among the findings of new analysis, published as a pre-released chapter of the 2021 IFS Green Budget, funded by the Nuffield Foundation and in partnership with Citi.

Looking ahead to the forthcoming Spending Review, the authors of an IFS report find that relying on council tax alone to deal with funding pressures is unlikely to be sustainable.

- Council tax increases alone are unlikely to be sufficient to meet councils’ costs over the next two years given the continuing need for some additional COVID-19-related spending, said the report.

- Researchers project that an increase of 4% in April 2022 could still leave English councils facing a £2.7 billion funding gap in 2022–23. Moreover, councils’ forecasts suggest that they will need a further top-up to their budgets over this winter to meet ongoing COVID-19 pressures.

- Council tax increases raise less in poorer parts of the country where more properties are in lower tax bands. For example, increases of 4% a year would raise £89 per person in cash terms by 2024–25 in the richest tenth of council areas, compared with just £61 per person in the poorest tenth. This would mean there would need to be bigger percentage increases in council tax bills to meet rising costs in poorer parts of the country, unless the government redistributes more of its grant funding to such areas.

The IFS chapter also finds that the UK government will very likely have to stump up considerably more for planned reforms to adult social care services in England.

- The government has said it will provide £5.4 billion over three years to begin the roll-out of a new lifetime cap on care costs and more generous means-testing arrangements, as well as higher payments for care providers, increased support for informal carers, investment in housing adaptations and supported housing, and workforce development. Given the scale of what the government wants to achieve, this funding is unlikely to be sufficient to meet the government’s stated aims in full over the next three years, said the IFS

- In the longer term, the annual cost of meeting the government’s ambitions for social care is likely to be around £5 billion a year, almost three times the average annual funding planned over the next three years. Funding for higher pay for care workers, or to enable councils to relax care needs assessments alongside changes to financial means-testing, could require billions more on top of this.

Finally, the chapter highlights how the formulae used to allocate funding between councils are out of date and in desperate need of reform:

- Existing funding formulae are still based on population sizes and characteristics in 2013. Yet, for example, the population of Blackpool is estimated to have fallen by more than 2%, while that of Tower Hamlets is estimated to have increased by over 20%. Failure to update funding formulae to account for changes in population and other factors driving needs means the government is less able to target funding to where it is most needed, potentially pushing up how much funding it has to provide overall.

Kate Ogden, a Research Economist at IFS and an author of the chapter, said:

“The government has stepped up with billions in additional funding for councils to support them through the last 18 months. It is likely to have to find billions more for councils over the next couple of years if they are to avoid cutting back on services, even if they increase council tax by 4% a year or more.”

Ogden said that the coming financial year is likely to be especially tough, with the likelihood of at least some ongoing COVID-19-related pressures, and a particularly tight overall spending envelope pencilled in.

“At the same time, government needs urgently to deal with a local government funding system that is becoming hopelessly out of date, being based on population levels and characteristics in 2013. This results in manifest unfairnesses in the distribution of resources between councils,” said the research economist.

David Phillips, an Associate Director at IFS and another author of the chapter, said: “The recently announced social care reforms pose major challenges for councils across England. The funding announced by government so far is unlikely to be enough to meet all of its objectives, in either the short or longer term.

“Without sufficient funding, councils may find themselves having to tighten the care needs assessments further in order to pay for the care cost cap and more generous means-testing arrangements.

“That would see some poorer people who would now be eligible losing access to council-funded care, so that coverage can be extended to other, typically financially better-off, people.”

Mark Franks, Director of Welfare at the Nuffield Foundation, said:

“Despite the government’s recently announced social care plan, even significant council tax increases risk not being sufficient to meet the future demand for local service provision or address staffing issues in the adult social care sector. Currently, many existing adult social care workers only receive minimum wage and zero-hours contracts are common, which has contributed to staff shortages in the sector. Until sustainable funding is in place to address these issues, disabled and older people are at risk of being unable to access the care they need.”

Articles you may find interesting:

Freelancers may have to pay back ‘COVID’ tax benefits – Freelance Informer

October: a month of many changes for freelancers – Freelance Informer

Making Tax Digital: “not fit” for Freelancers – Freelance Informer