The Electric vehicle (EV) market is booming. Sales are expected to reach 62 million units per year by 2050, with a total global EV stock of 700 million, according to new research from Wood Mackenzie. Will you get an early market advantage by taking your current skill set and adapting it to the world of electric vehicles?

When asked about the next car they buy, one in ten people said they expect it to be an electric vehicle (“EV”), and a further 41% said they may purchase one, according to research carried out by Alpha Real Capital LLP (“Alpha”), the specialist real assets investment manager, and Cornwall Insight, the provider of research, analysis, consulting and training to businesses and stakeholders in the British, Irish and Australian energy markets.

The EV sector will require rapid charging technology, renewable energy charge points and related servicing and products. From IT, coding, content, PR, photography, marketing, sales, components and motors, energy, construction, EV charging, customer service to engineering, the EV market will open to new business opportunities. Those business owners that brainstorm now as to how their business could provide goods or services to EV automakers and companies within the EV supply chain could have a very fruitful future in this very exciting sector.

One area of the UK that is welcoming EV giant Tesla with open arms is Wiltshire, home to the Mini, Dyson, and Honda factories, the latter, however, not for very long.

Tesla boss Elon Musk has been invited to take over Honda’s site in Swindon. The factory is scheduled to shut in the summer, and Swindon councillor Dale Heenan has contacted Musk via Twitter, asking him to consider turning it into a production base for Tesla’s vehicles.

Taking charge

At a whopping 88% of the total 416 million charging outlets globally by 2050, residential chargers are projected to be the primary mode of charging for EVs globally.

Rapid charging technology and charge point infrastructure are just two areas that will spur further growth and validate the sector. The UK will be leading the charge with legally binding zero-carbon targets.

Charge points alone will require 24/7 customer helplines online via apps and over the phone.

“In 2020, global EV sales surged 38% despite a decline of 20% in all car sales. Emissions regulations in western Europe were successful in doubling EV adoption despite the crippling coronavirus pandemic. This provides a roadmap for other countries and regions with similar goals to stimulate EV sales growth,” said Ram Chandrasekaran, Wood Mackenzie Principal Analyst.

Target automakers

Today’s major automakers – Volkswagen, Tesla, General Motors, Fiat-Peugeot, Renault-Nissan and Hyundai – will continue to make up a large share of future EVs. “Most automakers are a few years behind Tesla in terms of technology and efficiency. However, they can quickly outgun Tesla when it comes to manufacturing capacity and quality” added Chandrasekaran.

Lead by electric buses and light trucks, annual commercial EV sales are expected to top 3 million by 2025 and triple to nearly 9 million by 2030. Annual commercial vehicle sales are projected to reach 6.4million by 2050, while global stock will swell to 54million.

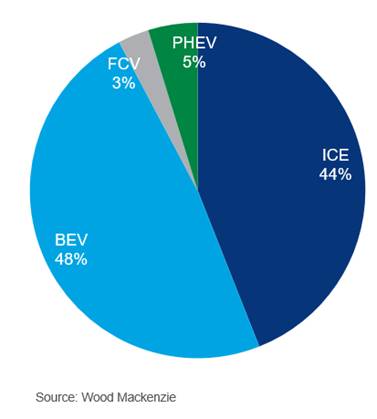

By 2047, battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV) and fuel cell vehicle (FCV) sales will combine to eclipse internal combustion engine (ICE) sales globally for light-duty vehicles for the first time.

EV sales are expected to top a combined 7 million a year in China, Europe and the US by 2025. Improved EV costs will propel sales and double EV numbers to a combined 15 million a year in those three regions by 2030. All automobile sales in Europe (86%), China (81%) and North America (78%) will predominantly be EVs by 2050, says Wood Mackenzie.

“Despite the growing dominance of EVs, global oil demand from light-duty vehicles is projected to reduce by only 24% over the next 30 years. Slow erosion of ICE stock and an increased demand from emerging economies are the main reasons for this lethargic drop,” said Chandrasekaran.