When Germany’s Wirecard filed for insolvency following the revelation that EUR1.9 billion ($2.1 billion) of cash had gone missing from its accounts, the UK’s Financial Conduct Authority (FCA) acted fast. But some UK freelancers and small businesses got caught in the crossfire, temporarily losing access to their funds. What will put faith back into Fintech for freelancers?

Access to Wirecard back, but now what?

The FCA ordered Wirecard’s UK unit, Wirecard Card Solutions, to stop carrying out regulated activities on 26 June, this in turn directly impacted freelancers, customers and businesses denying them access to their accounts via online banking apps, such as Curve, Pockit, Anna and U Account, that have integrated Wirecard into their services.

For three to four days, payment providers, online banks and their customers were fraught with worry as they were denied access to their accounts. But some payment providers were able to work through the weekend to find a solution, albeit not like for like.

Curve, a UK Fintech app that enables customers to put all their debit and credit card details into one Curve card or ‘wallet’ went to French fintech Checkout.com for some assistance to get its cards up and running after staff worked through the weekend immediately following the FCA announcement, CNBC reported.

Then on 29 June, the FCA provided written consent to allow Wirecard to resume issuing e-money and providing payment services to UK customers, which includes freelancers. The restriction on activities lifted at 00.01 on 30 June 2020. In the end, the end-users were not as burned as the actual retail investors in Wirecard. The company’s stock plunged after the scandal came to light in mid-June, freefalling from 104.50 euros per share ($117.26) on June 17 to 1.28 euros per share on June 26 (CNBC).

The FCA’s consent meant that Wirecard could resume electronic money and payment services to its customers and customers could use their cards as usual.

The primary objective of the FCA’s requirements was to protect the electronic money funds of consumers in safeguarded accounts. It also had the effect of preventing consumers from withdrawing and making payments with those funds.

Denied access?

Curve, however, is now working on new solutions and tooting its own horn, according to its website. “They say the devil works fast… but Curve works faster, as proven this weekend when we successfully migrated away from Wirecard in less than 60 hours.”

“We rebuilt in record time, and we’re not done yet: refunds are top of the agenda. Our focus isn’t singular here. As well as getting Wirecard-era refunds back into the pockets of our customers as quickly as possible, we’re building a brand new refunds process that’s going to be faster than before, and puts the customer in control,” the company said on its corporate blog.

Curve said that its customer research made it clear that the most important thing when it comes to refunds is speed – having money back as soon as possible. “This has largely informed our new approach to refunds,” said the Fintech.

Estonia-based XOLO, an accounting, invoicing and company incorporation service for international freelancers and hiring companies that use freelancers, has suspended issuing new Wirecard accounts to Xolo customers, the company told The Freelance Informer. Of Xolo’s 45,000 customers, just 0.3% had Wirecard accounts and is actively looking for a replacement.

In June, XOLO suggested that its new customers open accounts with either TransferWise or the Estonian bank LHV. Wirecard assured XOLO that their banking subsidiary, Wirecard Bank, will continue its normal operations and “is not part of the insolvency proceedings”.

XOLO confirmed in a statement that customers’ deposits held there are protected by two separate deposit guarantee schemes up to the amount of €19.7 million per customer.

“Our customers’ funds with Wirecard Bank are safe, however, if any of you wish to open a parallel bank account with our other partners we will happily lend our assistance,” the company said.

In my view, the competitive landscape along this plane is largely irrelevant as they are in the process of being replaced by higher-level providers. It’s equivalent of asking which dinosaur will dominate in the future. By definition, the future is always absent of dinosaurs,”

Ilya Paveliev

Who will replace Wirecard?

At the payment processor level, there are plenty of willing participants who can fill the gap left by Wirecard, according to Ilya Paveliev, a professed Fintech Geek, developer, and serial founder/investor (i.e., Zeux).

“These players are broadly quite similar with respect to the products or solutions that they provide to a rapidly evolving ecosystem. In my view, the competitive landscape along this plane is largely irrelevant as they are in the process of being replaced by higher-level providers. It’s equivalent of asking which dinosaur will dominate in the future. By definition, the future is always absent of dinosaurs,” Paveliev tells The Freelance Informer.

The Fintech specialist notes that at the next level, there is an emergence of open banking enabling players, such as Plaid, that completely change the rules of the game, to the benefit of consumer via lower costs and greater transparency.

“These players are beginning to provide a direct account to account payment solutions (PISP) that are alternatives to older payment rails (VISA, Mastercard). This change is reinforced by the defensive Plaid acquisition by VISA for silly multiples. So, the likely near-term service providers will look a lot less like Wirecard and more like Plaid,” he suggests.

“[Open banking] only really covers your current accounts,” Plaid’s UK director Keith Grose, says in a recent webinar panel organised by startup news site, Sifted. He continues, “And so the idea behind open finance is how do we extend that to the rest of someone’s financial life. If you want to manage your financial life properly, you need to have insight into all of your data,” said Grose.

What open finance suggests is customers have a single app to view not only their current accounts, credit cards, but also their ISAs, pension funds, and investments. The idea would be that customers will have a better view of what they are dealing with at any one point by seeing everything in one place. The next step is to have that data analysed by third party institutions (this is the opening up of your data to financial providers, hence ‘open finance’), such as credit card, loan, and mortgage providers as well as financial advisors or pension providers and use tools developed by Fintech apps to see if you are getting a good deal or vice versa third party providers suggesting you could get a lower pension fund fee with another provider.

During the Sifted webinar, Roisin Levine, head of banks at digital receipt business, Flux, said customers will see the value in not only open banking, but open finance when it starts to analyse their financial situation to the point that it can show, for example, what someone’s future cash flow will look like in the next six months. This, too, will be an excellent tool for freelancers and small-to-medium businesses that are tracking incomings, outgoings and future cash flow.

However, Levine reference research that illustrates just how slow the uptake of open finance is at present. Levine says there are “very, very low percentages” of people say they’re willing to share their data in exchange for “more personalised services.”

Once people can see what it can do for them, and they even have a say in the data they have analysed, the penny will drop. Levine suggests, “[We should ask]; do you want to ensure that the cash you have is in a high-interest account? Do you want to compare pricing on your insurance or… purchasing your energy? Then all of this stuff seems really common sense, and suddenly that applies to everyone.”

The catch is Fintech apps will be making revenues off any providers that you may switch or sign up to. This could be another ‘PPI’ mess if transparency on whole of market providers is not available; or if consumers are directed towards any one provider. The more institutions signed up, regulated ones, the better chance for the open finance segment’s success because this will spur competition and transparency. Well, that’s the idea at least.

Once the ‘Aha’ open finance moments start to roll in, those companies companies holding the data can monetise it by recommending new pension providers and taking a commission fee, for instance, or charging consumers for the service (like Monzo has done), according to the Sifted report.

Open Banking Market

“What’s going to make or break the success longer term is ‘do you feel confident that you know where this data is going?’” Grose noted, highlighting the need to educate users on their data rights and companies’ use of their data.

Customers can revoke their data being used at any time by third-parties, and regulators also have restrictions on companies’ ability to sell the data directly to third-parties. But unless customers are educated about this, they may be reticent to sign up. The Wirecard scandal for some freelancers, despite it being a poor management/financial due diligence call rather than a cybrsecurity or industry-wide problem will have want assurances they will have access to their funds. Their livelihoods depend on that, regardless of time saving and useful remote onboarding (signing up to open banking, etc. remotely).

“Companies like Plaid — which helps funnel users’ data between banks and apps — are now leading the push for regulators to implement open finance mechanisms. They make a revenue cut every time they help share data, hence wider regulation would directly benefit them,” according to Sifted in its webinar wrap-up report.

However, Paveliev takes things one step further. “If one wants to take it to the next level…we have blockchain. Blockchain can completely redefine the financial ecosystem to the point of making even Plaid irrelevant. This is a vision for the future, but we are not there just yet,” he admits.

Wirecard’s ‘DNA’ to blame, not Fintech

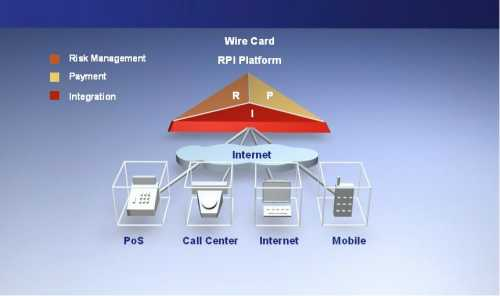

To set the stage. Wirecard’s inception in 1999 coincided with the peak of the first wave of internet-enabled eCommerce.

“Wirecard was a bridge connecting the new internet-enabled technologies with the old payment processing infrastructure (VISA, Mastercard payment rails),” says Paveliev.

“As you can imagine,” says Paveliev, “they were not the only payment online processor in town. It was a competitive space. Where Wirecard managed to stand out is via its focus on much riskier (higher margin) gambling and adult site sectors. They were willing to facilitate arguably fraudulent payment processing, choosing to trade off their ethical values for a higher margin. These choices have formed the core of its present-day DNA.”

Paveliev sees the unfortunate fall of Wirecard mostly rooted in its core lower risk-aversion DNA, with some fintech ecosystem participants being impacted directly and the whole ecosystem impacted on a reputation basis.

“This is a natural evolution of the fintech ecosystem, as the inertia of existing B2B fintech providers is slowly being accelerated by the disruptive forces of B2C innovations,” says the Fintech startup investor.

Allan Martinson, CEO of XOLO, says the Wirecard scandal is not exactly surprising due to the company’s origins, and is in no way a reflection of the Fintech industry.

Martinson says, in retrospect, the warnings signs of Wirecard were there. “Wirecard was always odd especially in the context of the early fraud reports by FT et al. In our opinion what happened to Wirecard is not representative to the whole industry. And we are pretty sure most Fintechs are now taking extra care to make sure their internal control mechanisms are adequate,” says the CEO.

“We are looking into alternatives to Wirecard,” says Martinson. “We do not think fintech is fundamentally broken quite the opposite. We have been talking to tens and working with several companies and they are significantly more transparent than Wirecard ever was.”

“Wirecard was always odd especially in the context of the early fraud reports by FT et al. In our opinion what happened to Wirecard is not representative to the whole industry.

Allan Martinson, CEO of XOLO

Faith in Fintech still low

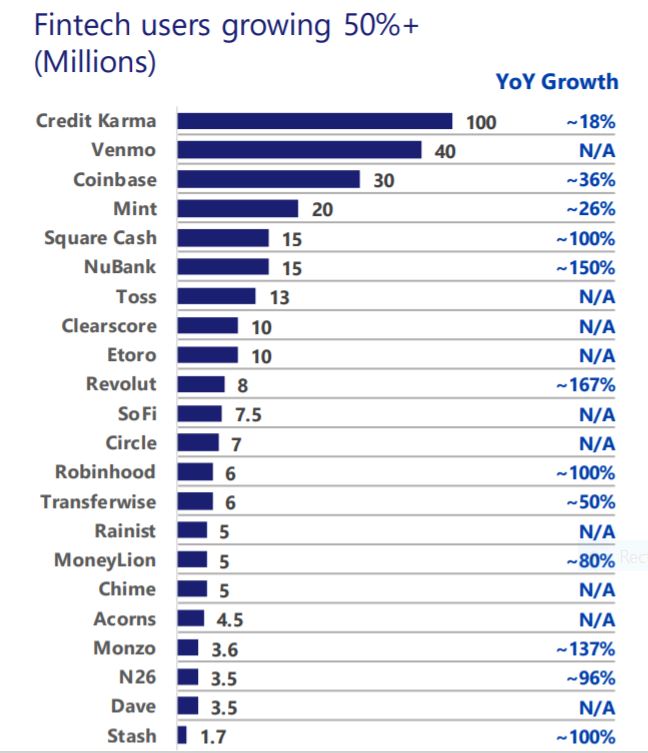

“The good news is that ‘faith’ in existing fintech pioneers is still relatively low, as reflected by a constant struggle by even the leading digital banks (Revolut) to convince customers to deposit all their savings or even wages,” says Paveliev.

“Just compare the offered savings rates between HSBC and Revolut, and you will get an indication of the uphill battle fintech face in gaining consumers’ faith. At this point, faith is still low and it ain’t cheap. Thankfully this dip is occurring at the early stages, not when Wirecard’s e-money custody is so big (think BNYMellon) that it results in systematic risks. It’s always better to expose system weaknesses early on, as the impact of the failure is smallest,” he suggests.

Another factor is that the customer’s faith in the established financial system has been on the accelerated decline since the GFC in 2008. This is particularly true for the Gen Y, who view the system as increasingly unfair (low savings rates + high borrowing cost).

“So, by the virtue of relativity, even if fintech ecosystem does nothing to improve its image it will still look like a better alternative to the established system as the time goes on,” suggests Paveliev.

From that viewpoint, the key part of helping to accelerate a consumer rise in faith in Fintech will be driven by their willingness to transpose their core B2C values downstream to their B2B enablers, he says.

He suggests the Fintech sector reflects on all existing relationships and to not tolerate potentially compromising arrangements or ‘hacks’ that made sense in the past.

“Start with a blank page,” says Paveliev, “and set a high bar (ethical, value proposition, dedication, etc.) for each provider to meet for inclusion. In the process, increase transparency and communication with consumers. Proactively answer their concerns and then go beyond. When it comes to restoring faith, a self-aware positive change with clear communication is the key.”

To learn more of the unfolding of the Wirecard scandal, check out this Financial Times video.