Construction workers could be owed millions by HMRC and they may not even know it, according to a tax fund specialist to the construction sector.

Research by tax refund experts, Rift Refunds, says that HMRC could be sitting on millions in unclaimed tax refunds owed to construction workers alone, who are either yet to claim or completely unaware they are even owed money.

RIFT’s data shows that PAYE construction workers could be failing to claim £300m a year and with the ability to backtrack these claims for the last four years, this could see them owed a lot more.

PAYE-back time?

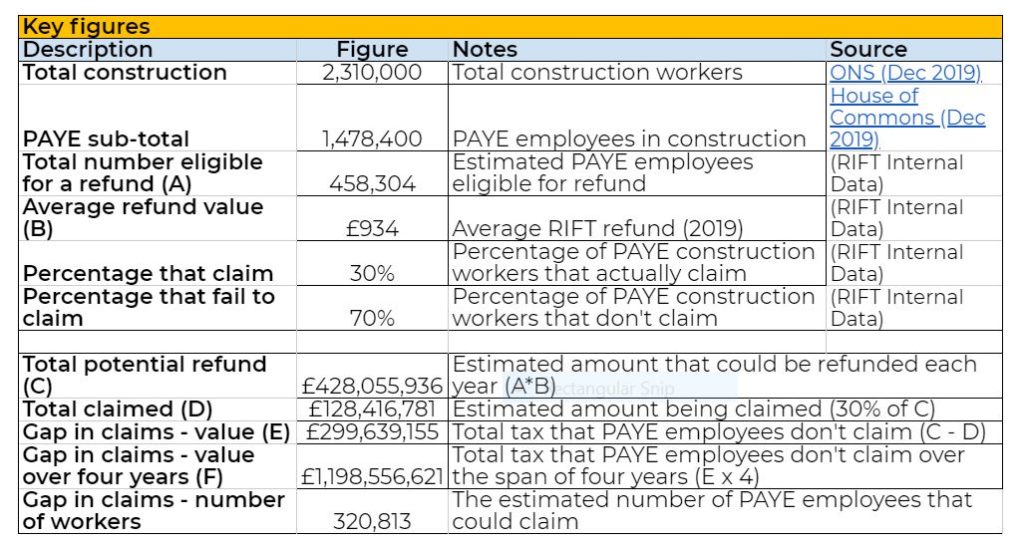

As of April 2020, there were an estimated 2.3m construction sector workers in the UK with 1,478,400 of these classed as PAYE employees. Unlike self-employed workers who deduct travel expenses as part of their annual self-assessment tax returns, many PAYE construction operatives like labourers, ground workers and bricklayers are required to claim these expenses back from HMRC each year.

RIFT, which claims to be the largest PAYE construction travel expense claim specialist in the UK, says that their data shows that 31% of all PAYE construction workers who qualify are eligible to receive a refund from HMRC. However, according to RIFT, the claims payout account for just 30% of the total money owed on an annual basis.

The average worker receives a refund of £934 per one year claim via RIFT and £3,735 as an average refund for a four-year claim, meaning that the total amount due to the 31% of PAYE construction workers eligible for a refund could sit as high as £428,055,936.

However, with possibly just 30% being claimed each year (£128,416,781), RIFT estimates that HMRC is sitting on an “eye-watering” annual sum of £299,639,155 in unclaimed tax refunds owed to some 320,813 PAYE construction workers. With workers also able to backtrack claims for up to four years, HMRC could be sitting on even more in rightfully owed tax, according to Rift’s estimations.

Uncertainty over under second COVID wave

“The construction industry has been looked after to a certain extent, but like the majority of sectors, workers are facing months of uncertainty,” says Bradley Post, Managing Director of RIFT Refunds.

“With many finding themselves on furlough [since April], we wanted to highlight that there is a notable cash sum due to PAYE construction workers from HMRC that they may be unaware of; money that could well make the difference over the coming months.”

Last year Rift claimed £20 million back from HMRC for construction workers but we know from our research that the vast majority are not receiving all of the help that they need to claim. The construction industry can be a lucrative one even for the ground level worker and so when things are good, the sum of a thousand pounds might not seem worth the trouble of dealing with HMRC for many.

“However, we also know in the wake of the last financial crisis when work was scarce, these refunds suddenly became a lifeline for many,” says Post.

Post encourages those worried about the months ahead, to look into this matter and reach out for help. Post says that they need just a few basic details.

“These refunds can also be backtracked over the space of four years so with this considered, the sum of money rightly owed starts to become quite substantial,” he says.