Where to invest your cash? Here are the historically best performing assets

If you had to invest your cash over a long period of time, which asset would give you the best chance for a solid or good return? Stocks and commodities, such as coffee can fluctuate severely, but if you have a diversified bundle of assets, such as domestic and international stocks and bonds, plus stalwarts such as gold, this can be balanced over time.

Best performer in 2020

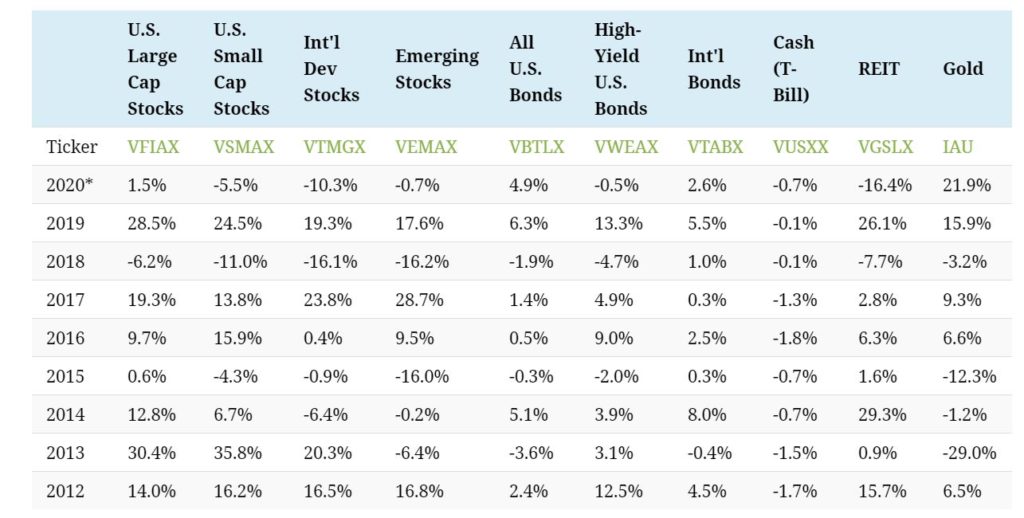

The top-performing asset class so far in 2020 is gold, with a return more than four times that of second-place U.S. bonds, Visual Capitalist has reported. On the other hand, real estate investment trusts (REITs) have been the worst-performing investments. Needless to say, economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate.

Real estate once used for retail and office space is likely to be repurposed into community green and residential space, including social care, but this may take anywhere between three to five years to come into effect, with infrastructure funds the likely investor to take up the opportunity, according to BuzzVestor Media.

According to Visual Capitalist, over time, the order is fairly random with asset classes moving up and down the ranks. For example, emerging market stocks plummeted to last place amid the global financial crisis in 2008, only to rise to the top the following year. International bonds were near the bottom of the barrel in 2017, but rose to the top during the 2018 market selloff.

There are also large swings in the returns investors can expect in any given year. While the best-performing asset class returned just 1% in 2018, it returned a whopping 71.5% in 2009.

Upon reviewing the historical returns by asset class, there’s no particular investment that has consistently outperformed. Rankings have changed over time depending on a number of economic variables.

“Having a variety of asset classes can ensure you are best positioned to take advantage of tailwinds in any particular year. For instance, bonds have a low correlation with stocks and can cushion against losses during market downturns.

If your mirror could talk, it would tell you there’s no one asset class to rule them all—but a mix of asset classes may be your best chance at success,” reported Visual Capitalist.

To see more historical asset class performances in infographics click here.