IR35: Move abroad and you’ll get preferential treatment from UK clients, says contractor

READER LETTERS

I have been following your newsletter and meaning to get in touch for a while. I am one of the many small business operators in the IT sector who emigrated in recent years due to IR35 changes and ever-increasing taxes even while staying outside IR35.

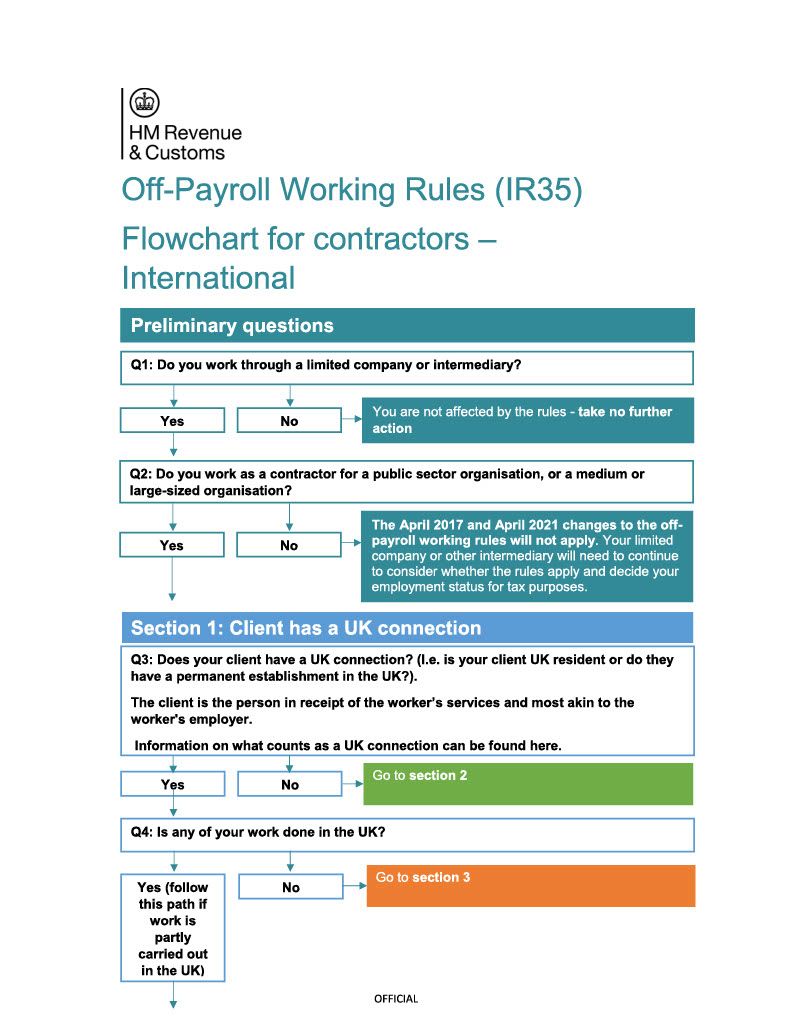

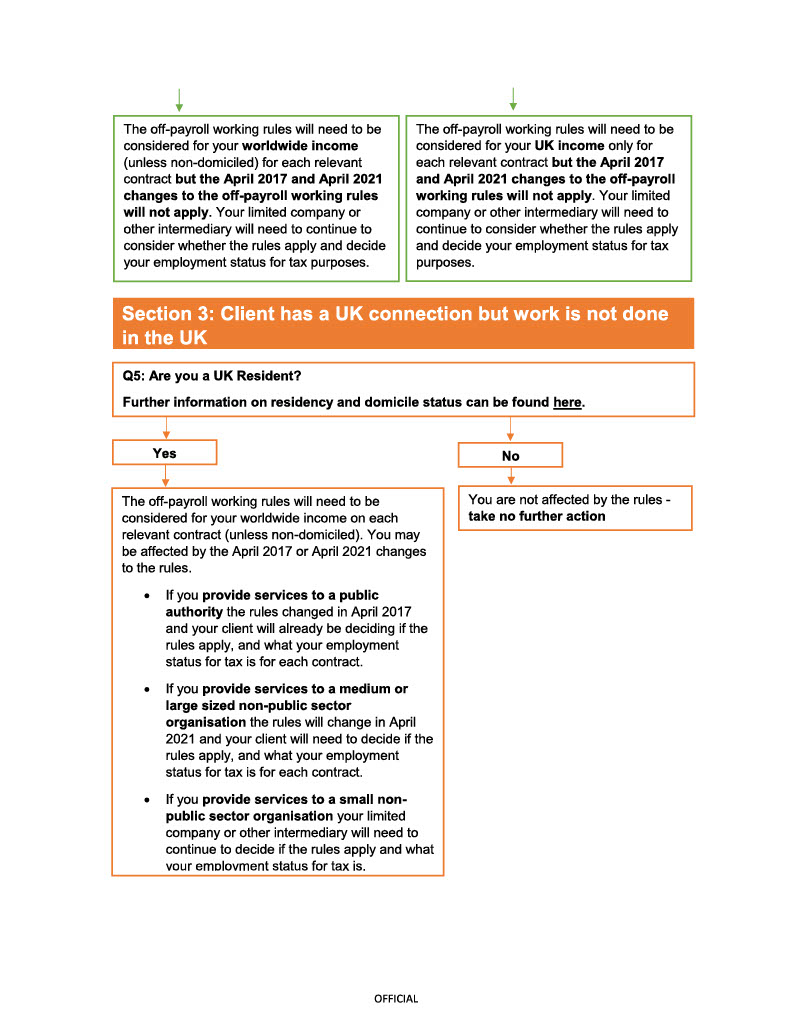

Obviously, when working for clients outside the UK, while being a tax resident outside the UK, IR35 does not apply, but what is far more interesting and noteworthy is a document (see below) I recently got a copy of, which I’m told HMRC shared in an IR35 webinar last year.

What it effectively seems to show is that emigrating, becoming a tax resident elsewhere, and then taking on a remote working contract (and over the past 2 years most IT jobs have been remote, and this trend continues), automatically puts the assignment outside of scope IR35.

It effectively means that companies can hire no-rights employees from abroad as contractors with impunity while having to jump through many IR35-related hoops if wanting to hire a UK-based contractor instead, and then still risk protracted investigations years later. But if hiring a contractor based abroad, both the difficulties and the risk disappear entirely.

For me, emigrating just before Brexit was an easy decision because fewer than 20% of my clients and less than 10% of my business’ revenue were from the UK, especially since there are countries in the EU with taxes that are 2 to 5 times lower than in the UK (for example, 10% flat rate corporation tax, 10% flat-rate income tax, 5% flat rate dividend tax).

But what I found shocking was that having emigrated, it seems that, quite absurdly, I would actually have preferential treatment from prospective UK-based clients when it comes to contracts that would be considered inside IR35.

Have you moved abroad and found a similar experience? If so, contact us here.

👀Are you considering moving abroad to find a more flexible and welcoming contractor market? Look out for our special report on how to plan a move abroad as a freelancer or contractor

Articles you may have missed, check out the IR35 Archives – Freelance Informer

I’m finding the exact opposite. I was made aware that IR35 is no longer applicable to me but many companies won’t touch me now because they want someone local. Really I see this as a continuation of the dinosaur office model, which so many old school managers refuse to let go of. In time that will change as they fade away.

In general, the more contractors share ideas on how to avoid paying tax in the UK, the more HMRC will remorselessly close the loops. Plus, born and bred UK residents will struggle to justify moving to a low tax Euro regime to their families for the sake of saving (some) tax. Many (not born and bred) enjoy the benefits and safety of the UK, and coincidentially its easy for them to relocate back to their country of lower-tax origin, while enjoying the higher-pay-rates of the UK.

The facts are that too many takers from the public purse (benefits) requires governments to extract more taxes from the people they can target. Its not personal, but rather fact of life. (Put people off buying nicotine products, the NHS has to be funded from another tax source).

Nicotine products cost the NHS far more in care rush any tax they might see. Trying to blame “takers”, with no evidence, just ignores the real problems.

Interesting. Which countries in the EU have 10% flat rate corporation tax, 10% flat-rate income tax, and 5% flat rate dividend tax, please?

At a flat 10%, Bulgaria has the European Union’s lowest personal income tax rates. Corporate income tax rates are the same flat rate of 10% (tied with Cyprus), and Bulgaria maintains tax treaties with many countries that could allow for special tax treatment for some international entrepreneurs. For more countries that are claimed to have lower interest rates for freelancers, try here: https://nomadcapitalist.com/finance/low-tax-countries-living-europe-2022/

Please could the OP share details of “countries in the EU with taxes that are 2 to 5 times lower than in the UK (for example, 10% flat rate corporation tax, 10% flat-rate income tax, 5% flat rate dividend tax).” I would be very interested in exploring those with a view to relocation. as up to now I’ve found taxes in NL, FR, DE and IT just as “taxing” as those in the UK. TIA.

At a flat 10%, Bulgaria has the European Union’s lowest personal income tax rates. Corporate income tax rates are the same flat rate of 10% (tied with Cyprus), and Bulgaria maintains tax treaties with many countries that could allow for special tax treatment for some international entrepreneurs. For more countries that are claimed to have lower interest rates for freelancers, try here: https://nomadcapitalist.com/finance/low-tax-countries-living-europe-2022/

Whilst technically correct from a UK perspective, this article gives a very one-sided view as it completely ignores the fact that other countries also have rules about off-payroll working which would need to be considered by both the contractor and the engager, often more strict than those of the UK, albeit perhaps less engaged-with by expat migrant workers.

Short answer: No, “off payroll” or IR35 doesn’t exist as a concept in countries with sane tax regimes.

Long answer: Since we are mainly talking about Bulgaria here, I can tell you there is no equivalent to off payroll rules here. Why would there be when corporation tax at 10% is the same as flat rate as income tax? There is nothing to be gained one way or the other.

And before you say national insurance / social security, this works works out similar against the 5% dividend tax low down, and because income subject to insurance is limited to something like 25K, it doesn’t take earning a lot on the contract rates scale before you are actually better off paying to yourself as a salary than dividends.

Bulgaria is not the only one. Hungary similarly has flat rate taxes (9% corporation tax, 15% income/dividend tax). Higher than Bulgaria but still multiples lower than most Western European countries. Cyprus is pretty good, too.

HMRC views on “UK connection” appear to be wrong to me in law. They have frightened a lot of multinationals in Ireland to apply IR35 rules as they also have UK operations. However the Irish operation is typically a completely separate legal entity and UK tax laws cannot apply to that entity. HMRC are crooks.