Childminders in the UK must get rates aligned to survive

Childminding can be a rewarding career. However, self-employed childminders across the UK could be short-changing themselves and their own families with below-living wage rates, agency and set-up fees and ongoing costs.

Childminding is an important business. It acts as a much-needed service to working parents and society. However, when you compare how much childminders are pressured by society to charge by the hour, it’s historically been below the government’s living wage. That is not sustainable for the childminder’s business or for them as an individual. That’s why many childminders have left the sector. They couldn’t afford to go on subsidising Britain’s childcare and educational needs as self-employed people.

The Department of Education (DfE) reported that the number of early years providers dropped by three per cent between 2021 and 2022.

However, with the government providing promising more financial support to parents putting their children in childcare, we could see more childminders re-enter the industry or join for the first time. However, before they do, they need to create a winning business plan that works for their own family and the needs of the children they care for.

Childminder incentive grants

Following the chancellor’s March 2023 budget, every childminder will receive an incentive payment as part of a pilot scheme to increase the number of childminders in the UK. People who start working as childminders are set to receive an incentive grant of £600 when they sign up through Ofsted. However, the amount on offer will increase to £1200 for those joining through a childminding agency.

While joining a childminding agency will give you some extra cash, you will be liable to provide a percentage of your self-employed earnings to the agency. For example, childcare agency Tiney charges 12% in the first year and then every year after 8% on the first £50,000 of earnings. This is a sizeable amount of your income plus any NI taxes and set-up and ongoing costs. You have to do the maths to compare if you could do your own marketing, hire a bookkeeper/accountant and ensure your certifications and home-based business are up to code before trading and for future Ofsted inspections.

Ask a childminder agency exactly what they will be doing for you and what you actually have to prepare regardless of their assistance. For example, you will likely still have to prepare and input your expenses and receipts to them either online or in person. You may also have to submit your own self-assessment and corporation tax paperwork, so it’s always good to ask as every agency will be different. Shop around for accountants, invoicing and tax services, etc.

What HMRC says: Grants received by childminders to help them to start up their businesses or to meet capital or running costs should be dealt with following normal principles, see BIM40450 onwards. If a grant is received before the business begins to trade, it is not a trade receipt. A start-up grant may reduce the amount of pre-trading expenditure on which relief is available, see BIM46355.

What do you get for your childminder agency (CMAs) fees?

As well as the formal legal requirements around registration, quality assurance and CPD, CMAs are also able to offer a range of other services to childminders and parents. For example:

- administrative support

- marketing to families

- networking opportunities

They may also, in agreement with their providers:

- provide invoicing services

- manage parental fees on behalf of providers

- administer paperwork for tax and National Insurance (NI) contributions on behalf of providers or their assistants

- arrange accountancy services for providers

CMAs may also be able to help:

- providers – to work with local authorities to deliver free early education places and manage the funding on their providers’ behalf

- parents – to access other forms of government support towards the cost of childcare, such as tax credits, Universal Credit or Tax-Free Childcare (TFC)

- new childcare provider applicants – to meet all mandatory pre-registration training requirements, including those set out in the EYFS statutory framework

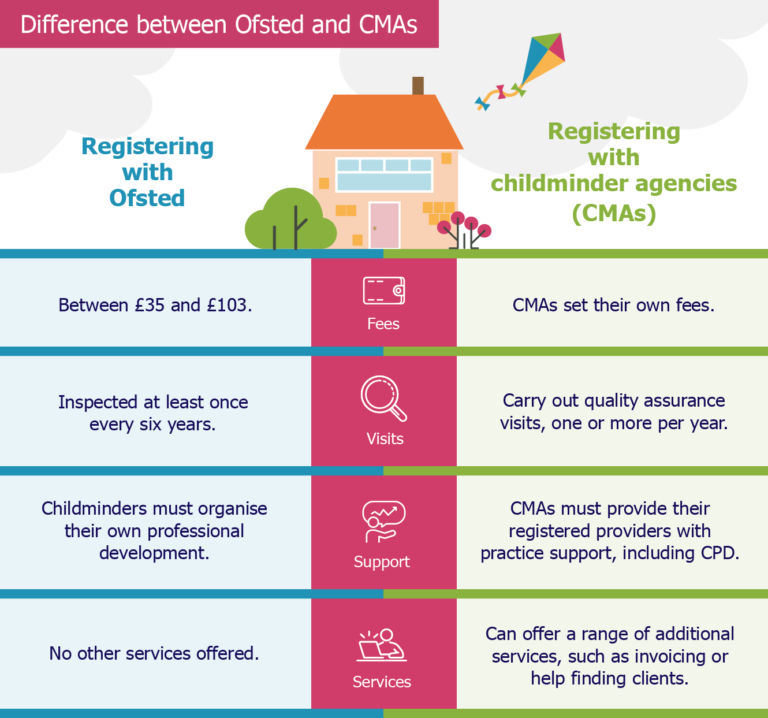

Ofsted or a childminder agency?

When you register with Ofsted you will need to pay an annual registration fee. You’ll also have to pay for things like Disclosure and Barring Service (DBS) checks, training and insurance. These are all business set-up and ongoing costs, so keep this in mind when deciding whether to go with Ofsted or an agency, the latter will cost you more for any support they provide. If you register with an agency instead, you’ll need to discuss these costs directly with them.

One of the biggest headaches for childminders is invoicing and chasing payments from parents, especially those that may pay through government means, i.e., Universal Credit. However, there are invoicing and bookkeeping apps out there for the self-employed, so you have to weigh up if an agency can provide anything better or more competitive in price.

If you are self-employed you can set your own rates, charge extra for food, drink and outings and inform parents of these fees in advance and include them in each invoice. You could also offer discounts to parents for early weekly or monthly payments. You would just have to ensure you are not out of pocket when you weigh up the costs to run your business. How you determine your base hourly or day rate is key to whether discounted payments are a smart move.

Cost of living wages: how much should childminders charge?

These rates below are for the National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school-leaving age). The rates change on 1 April every year. As a childminder, you may offer a day rate that tallies up to a full day of these hourly rates, plus any extras you provide. If you are charging less you have to make sure this is sustainable. You are a business, not a babysitter.

How do your rates compare to the living wage?

| 23 and over | 21 to 22 | 18 to 20 | Under 18 | Apprentice | |

|---|---|---|---|---|---|

| April 2023 | £10.42 | £10.18 | £7.49 | £5.28 | £5.28 |

Registration fees: how do they compare?

| Cost for childminders | Cost for nannies | |

|---|---|---|

| Childminders – caring only for children aged 5 or under | £35 | Not applicable |

| Childminders – caring only for children aged 5 or older | £103 | Not applicable |

| Childminders – caring for children of all ages | £35 | Not applicable |

| Register as a nanny | Not applicable | £103 |

DBS checks and health checks

| Cost for childminders | Cost for nannies | |

|---|---|---|

| Your DBS check | £38 | £38 |

| Checks for adults in your home | £38 each | Not applicable |

| Criminal DBS update service (recommended) | £13/year | £13/year |

| GP to fill in and sign health declaration booklet | £90 (approximately) | Not applicable |

Training

| Cost for childminders | Cost for nannies | |

|---|---|---|

| First aid course to cover the age groups you look after | £60 to £200 (approximately) | £60 to £200 (approximately) |

| Childcare training on the type of care you will provide – ask your council | £50 to £200 (approximately) | £60 to £200 (approximately) |

Other costs

| Insurance | Cost |

|---|---|

| Public liability insurance | £25 to £100 (approximately) |

| Keeping digital records | Cost |

|---|---|

| Register with ICO to keep digital records of children (childminders only) | £40 |

Receipts are not required for items costing less than £10. Receipts are required if a number of smaller items are purchased at one time and the total cost is £10 or more.

Household expenditure

The HMRC says household expenditure is based on the hours that childminders work and not on the number of children they care for. A childminder looking after a child on a full-time basis for 40 or more hours each week is entitled to claim the full-time proportion of expenses.

How this works is illustrated in the following table:

| Hours worked | % of Heating and lighting costs | % of Water rates, Council Tax and Rent |

|---|---|---|

| 10 | 8% | 2% |

| 15 | 12% | 4% |

| 20 | 17% | 5% |

| 25 | 21% | 6% |

| 30 | 25% | 7% |

| 35 | 29% | 9% |

| 40 (full time) | 33% | 10% |

The full-time figures shown in the table should be scaled down depending on hours worked.

Wear and tear of household furnishings

A deduction of 10% of total childminding income may be made to cover the wear and tear of furniture and household items.

Food and drink

Reasonable estimates for the costs of food and drink provided for the children being cared for are acceptable and receipts are not required.

Car expenses

Where appropriate, childminders can use the simplified expenses mileage rates. However, if the childminder wishes, the actual cost of car expenses for childminding purposes can be claimed instead.

Other costs

Also allowable – the cost of toys, outings, books, safety equipment, stationery, travel fares, membership fees or subscriptions to your childminding organisation, public liability insurance premiums and the actual cost of telephone use for childminding purposes.

Create a business plan

Just as in any startup, running a childminding business should aim to be profitable and enjoyable. Setting up a business plan with your financial and lifestyle goals in mind will help you determine your rates and how you could grow your business and services over time.